How To Subtract Gst From Total Amount

Working backwards to find the GST and GST exclusive amounts from the total GST inclusive price. Claiming GST as an international traveller.

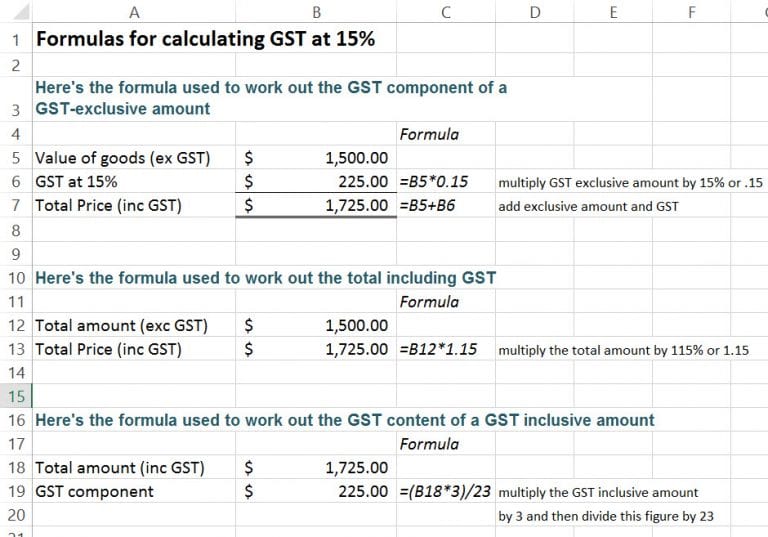

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

You can type either value into.

How to subtract gst from total amount. New Zealands BEST GST Calculator - so simple to use on your computer or mobile. You have price without GST and you need to calculate final price including GST. Click on the cell containing a subtrahend a number to be subtracted to add its reference to the formula B2.

To figure out how much GST was included in the price you have to divide the price by 11 2201120. Here are two scenarios. Multiply by 23 divide by 3.

You can also calculate the GST amount by using the following formula. In the example below B5 has been multiplied by 015 which is the same as 15. Multiply by 3 divide by 23.

Add or Subtract GST with precision. To work out the price without GST you have to divide the amount by 11 22011200 Avoid most common GST calculation mistake when using percentages. This gives you the pre-tax price of the item.

You have the original tax invoice for. To find the total including GST simply add the two values together. Your purchase was made within 60 days before leaving Australia.

I need a formula that calculates the -5 GST I can not just subtract Total - GST. You can see that to find the total before GST all you need to do is divide by 105. Subtract the Tax Paid From the Total Subtract the amount of tax you paid from the total post-tax price of the item.

For example if your total amount was 112 of which 5 was GST you will be left with 107 when you take the GST out of the amount. GST Amount Value of supply x GST The total amount of goods Total value of goods GST amount. In the example if your bill including GST was 229 then 229 divided by 105 equals 21810.

GST calculation is quite simple. 115 X 3 23 15 GST. Amount with taxes Canada Province.

Quickly find 15 GST amount for any price or work backwards to get the original GST-exclusive price if you only have the GST-inclusive one. Know matter what I try I cannot seem to get the correct value. Write the total amount on a blank piece of paper.

Subtract the GST from the total amount and the resulting figure is the amount with the GST taken out of it. The GST is the difference between this and the aftertax total. Do that for 1700 and you have your subtotal.

Base_amount 100 GST 100 005 5 and final_price 100 105 105. Even on separate. Multiply by 20 divide by 3.

Base_amount is a price before GST is applied GST base_amount 005. GST Inclusive Price X 3 23 GST Amount. Click on the cell containing a minuend a number from which another number is to be subtracted.

To do this you simply multiply the value excluding GST by 15 or by 015. Mentioned below are steps to be followed for calculating GST through GST Calculation Tool. HSTQSTPST variable rates Amount without tax Current HST GST and PST rates table of 2021 On March 23 2017 the Saskatchewan PST as.

I am trying to take out the GST witch is 5 from the total. Divide the bill for the goods or services by one plus the GST. Select GST InclusiveGST Exclusive as per the requirement Step 2.

Example shown 300 is the GST amount. 63 - 60 3. If the GST is excluded in the value of supply.

Click on Calculate to check the result. 200 10 220 however 220 - 10 is NOT equal 200 actually its 198. Inland Revenue IRD recommends the following formula to find the GST amount from a GST inclusive price.

Its reference will be added to the formula automatically A2. Calculating GST has never been easier on our handy NZ GST Calculator. Calculate inclusive and exlcusive GST amounts now.

If the GST is included in the value of supply. So if you paid 2675 in total for two books and you know from looking at the receipt that 175 of. I do not always know the PST amount witch is 8.

Final_price base_amount 105. Type a minus sign -. GST Amount Value of supply Value of supply x 100100GST.

So the end amount should be 6477. Select the GST rate from the drop down menu list Step 4. To get GST inclusive amount multiply GST exclusive value by 107 300 is GST exclusive value 300 107 321 GST inclusive amount To get GST part of GST inclusive amount you need divide GST inclusive amount by 107 and multiply by 7.

Your purchases are from a single business with the same Australian Business Number ABN and total AU300 GST inclusive or more. Then subtract that from 1700 to get the amount of GST you paid. Enter the original amount Step 3.

Underneath it write down the total amount of GST charged. Subtract your bill without GST from Step 2 from the bill for the goods or services with the GST to find the GST. This is your bill without GST.

How To Calculate Gst Or Income Tax In Excel

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Calculate Gst Percentage In Excel How To Wiki 89

Gst Calculator How To Calculate Gst

Singaporean Gst Calculator Gstcalculator Net

If The Total Amount Is Rs 2065 Including The Gst 18 Then What Is The Actual Price Quora

Best Excel Tutorial How To Calculate Gst

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Calculate The Gst In Australia Video Lesson Transcript Study Com

Best Excel Tutorial How To Calculate Gst

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

Gst Calculator Calculate Gst Online Gst Calculation Formula

How To Correctly Calculate Gst Figures Kiwitax

If The Total Amount Is Rs 2065 Including The Gst 18 Then What Is The Actual Price Quora

How To Make Calculating Gst Easier

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

How To Calculate Gst Amount Online With Formula Gst Calculator